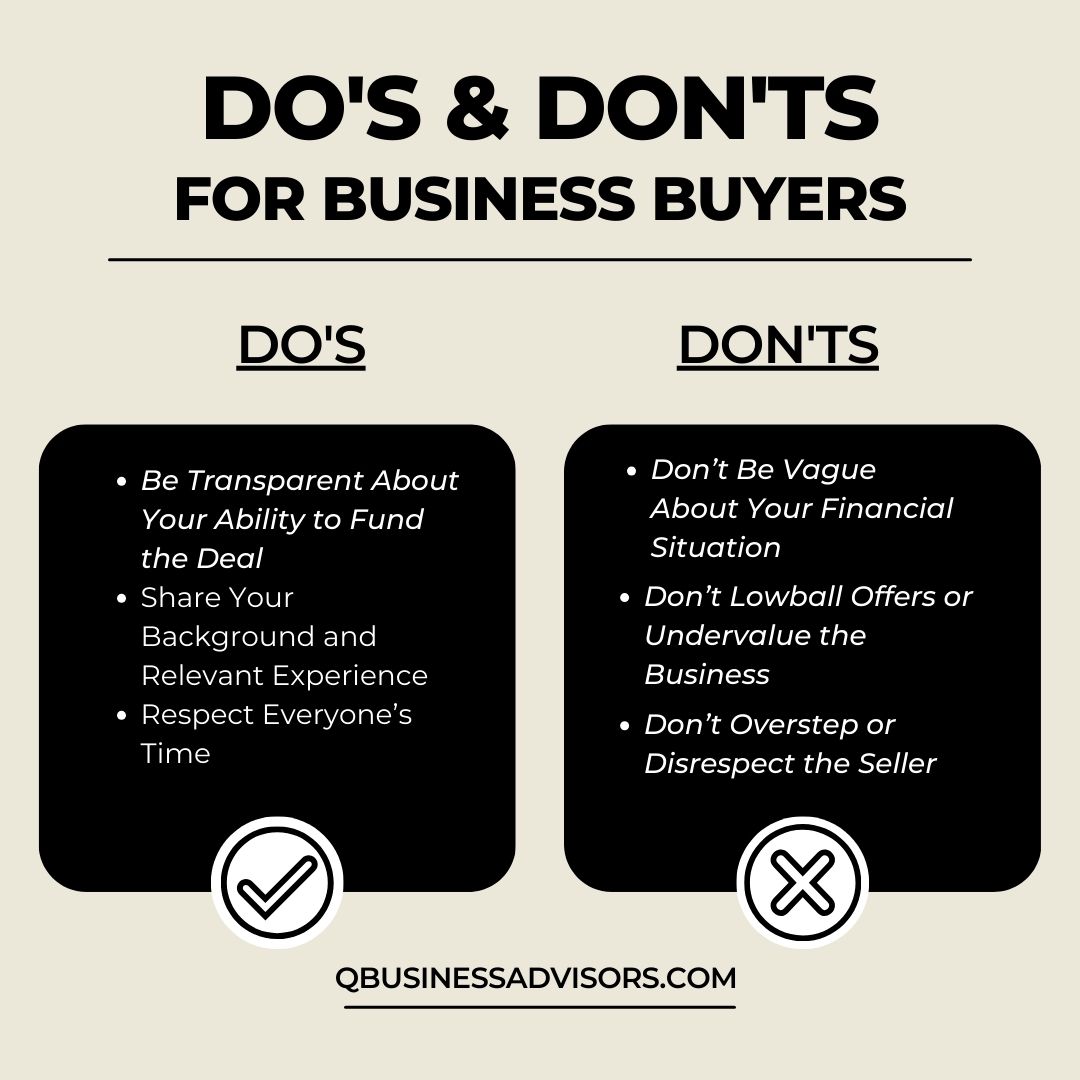

Do’s:

- Share Your Funding Plan

Be open about how you plan to finance the purchase. Whether it’s an SBA loan or personal funds, providing details and documentation builds trust. If someone else is helping with funding, involve them early and ensure they’re ready to sign any required agreements. - Highlight Your Experience

Share a little about your professional background and skills that would help you run the business. This reassures both the broker and seller that you’re a good match for the opportunity. - Be Thoughtful About Time

Respect the schedules of the broker and seller by being mindful when requesting meetings or additional information. Treating their time as valuable sets a positive tone for the relationship.

Don’ts:

- Avoid Being Vague About Finances

Phrases like “I’ll get the money when I need it” can make brokers hesitant. Instead, provide clear information about your resources to show you’re prepared to move forward. - Don’t Undermine the Business

Offering constructive feedback is fine, but avoid over-criticizing or undervaluing the business. Sellers have worked hard to build their business, and a respectful approach goes a long way. - Skip Unrealistic Demands

It’s best to avoid last-minute meeting requests or excessive demands for information. A balanced and reasonable approach helps maintain goodwill and keeps the process moving smoothly.

The author Anthony John Rigney is the Broker and Owner at Quorum Business Advisors. A leading Florida based business brokerage.

To start a conversation you can contact us here.